The New Year is around the corner and with it begins the new tax filing season. As 2026 approaches, however, you should begin preparing for some sweeping changes in the U.S. tax landscape.

Those changes are primarily due to the passage of the Working Families Tax Cut Bill, commonly referred to as the “One Big Beautiful Bill.”

The new legislation is designed to permanently extend most of the provisions of the Tax Cuts and Jobs Act of 2017 (TCJA).

The One Big Beautiful Bill includes a variety of new tax provisions that will affect you, your family, and small business owners.

Here is what you need to know and what you can expect to happen come Jan. 1, 2026.

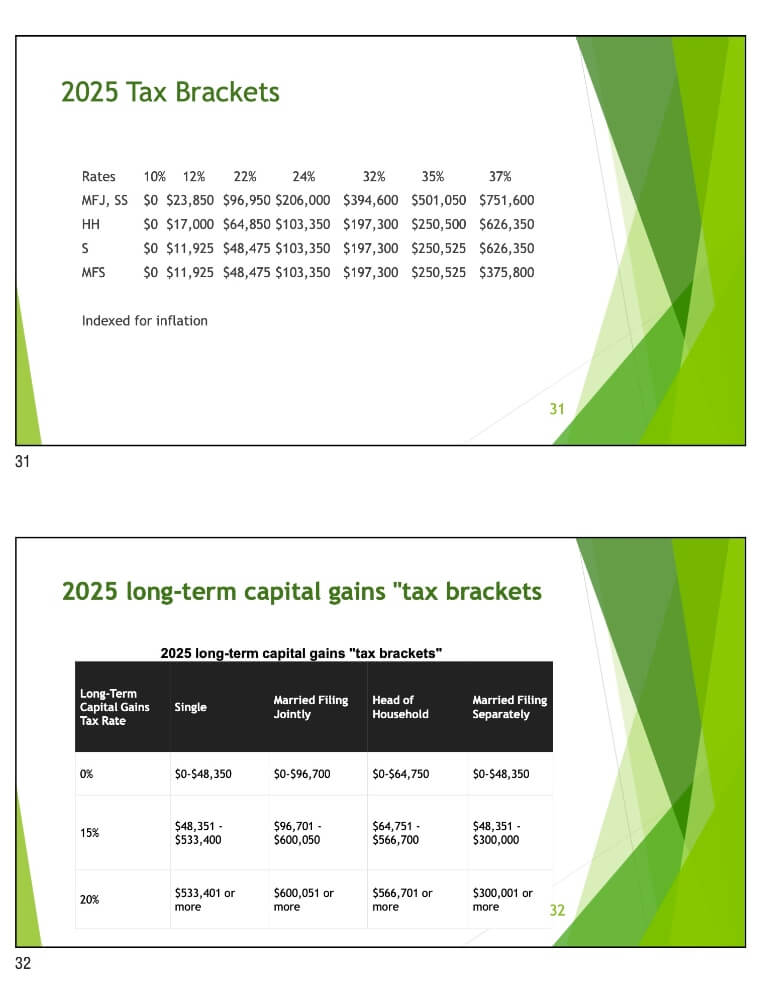

1. 2025 Tax Brackets

The seven federal income tax income brackets include the 10%, 12%, 22%, 24%, 32%, 35%, and 37% brackets.

Beginning in 2026, the standard deduction increases to $32,200 for married couples filing jointly; $16,100 for single taxpayers and married individuals filing separately; and $24,150 for heads of households.

2. Changes to the Child Tax and Child and Dependent Care Credits

Child Tax Credit: The maximum federal child tax credit has increased to $2,200 for qualified taxpayers with an adjusted gross income (“AGI”) lower than $200,000 for single filers and $400,000 for married filing joint filers. The credit reduces $50 per $1,000 over these amounts. A social security number for parents claiming the tax break will be necessary.

In addition, parents living in New York State will now receive a maximum $1,000 NY Child tax credit for each child under the age 4 (formerly, this was $330), and a NY Child tax credit of $330 for each child between the ages of 4 and 16. Phase out begins reducing the credit by $50 for every $1,000 over $110,000 married filing jointly and $55,000 for head of households and married filing separately.

Child and Dependent Care Credit: The maximum qualifying expenses you can use to claim the Child and Dependent Care Credit is $3,000 for one child and $6,000 for two or more children. The percentage allowed that you can take of the qualifying expenses is between 20% and 35% with a decrease of 1% for every $2,000 over $15,000 of AGI. Beginning in 2026, the credit will increase to 50% for lower income families, but filers will need to have a tax liability to benefit fully from it. Those eligible for this benefit must be paying for childcare for children under 13 and must also be working or looking for work.

Partially Refundable Adoption Credit: In 2026, the maximum credit allowed for adoption expenses will be $17,670. The actual amount of credit that may be refundable is $5,120.

3. Increases to the Alternative Minimum Tax (AMT) Exemption

The increased AMT exemption, which typically allows taxpayers to reduce their taxable income, as well as phase-out thresholds, have been made permanent. These amounts will now be $90,100 for single filers and heads of households and $140,200 for married couples filing jointly.

Considering the above changes, you should look at the overall tax impact on years 2025 and 2026, with the goal of reducing your federal income tax liability for both.

That might mean accelerating write-offs from 2026 into 2025 while deferring taxable income. In summary, that means that you will have the flexibility to shift write-offs from one year to another.

4. State and Local Taxes (SALT) Deduction Cap to Expire

The SALT deduction cap, which allows you to deduct state and local taxes on your return, has been raised to $40,000 for married couples earning up to $500,000. If your AGI is above that, you can still deduct up to $10,000, just like under current law.

The expanded cap will increase annually for inflation through 2029, giving you extra room if local taxes rise over time.

This new change will mean that some taxpayers will now be able to itemize more on their 2025 tax returns.

5. Estate and Gift Tax Exemptions to be Cut in Half

The lifetime federal estate and gift tax exemption increases to $15 million per person and $30 million for married couples beginning in 2026.

6. Additional Deduction for Seniors

Beginning in 2025, seniors over 65 years of age can claim an additional standard deduction of $6,000 or $12,000 for married couples. This is phased out by 6% when AGI is over $75,000 for single filers and $150,000 for those married filing jointly and completely phased out at $175,000 and $250,000 married filing jointly.

This change is applicable for years 2025-2028 only. You do not need to be collecting social security to receive the benefit but must have a social security number.

7. Effects on Retirement Planning

If you’re a retiree, you may benefit from converting your traditional retirement accounts to Roth IRAs, which will allow for tax-free growth into the future. Going forward it is important to pay attention to the required minimum distribution rules for traditional IRAs. If you’re over 73, you must take annual payouts from your tax-deferred retirement accounts.

8. Additional Key Tax Changes

Other changes that may or may not affect you include the following:

No Tax on Tips: A deduction of up to $25,000 per taxpayer per year will be available for eligible workers in specific occupations. The deduction phases out by $100 for every $1,000 of your Modified Adjusted Gross Income (MAGI) above $150,000 for single filers and $300,000 for married couples filing jointly. You must have a valid social security number.

No Tax on Overtime: A deduction of up to $12,500 per taxpayer is available for eligible workers. The deduction phases out by $100 for every $1,000 of your Modified Adjusted Gross Income over $150,000 or over $300,000 married filing jointly.

No Tax on Car Loan Interest: You can deduct up to $10,000 in interest off a new vehicle loan only. The debt must be incurred between 2025 and 2028. The deduction phases out at 20% of the amount of your Modified Adjusted Gross Income over $100,000 to $150,000 or over $200,000 to $250,000 married filing jointly.

Business Meal Expense Deductions: Significant changes are set to begin in 2026, with many employer-provided meals no longer deductible. Meals with clients and certain company events remain deductible. They include a 50% deduction for business meals with clients, meals while traveling for work, meals at a conference, and food items for the office. A 100% deduction will be available for food that is used for company holiday parties and food and beverages offered to the public.

Trump Accounts: Children born between 2025 and 2028 will be eligible for this new tax-deferred savings account that comes with a one-time federal funded deposit of $1,000. Contributions are limited to $5,000 annually adjusted for inflation and they must be invested in a well-established index fund. All recipients must have a social security number and be American citizens. For 2025 births, the law is in effect now, but the actual account creation and funding mechanics begin when Trump accounts open for contributions on July 4, 2026. Parents or guardians will need to file a new IRS form (currently drafted as Form 4547) to elect and establish the account so that Treasury can make the $1,000 deposit for an eligible 2025 born child.

Digital Asset Reporting: If you hold a digital currency, you will be expected to report transactions on your tax returns.

If you still have questions about the impending tax changes, be sure to reach out to our office by emailing info@tuffyassociates.com